Featured

- Get link

- X

- Other Apps

My eTims Journey, Or How I Discovered that William Ruto is Just About to Destroy Entrepreneurship in Kenya

It all started innocently enough, on a high and very jubilant note too:

But what followed quickly wiped the blithe smirk from my façade. The pain we were warned about back in December descended immensely and immediately, without warning or meandering.

Many of you hustlers do not grasp the magnitude of the effects of the provisions of the Finance Act 2023.

— African Out (@AfricanOut1) December 30, 2023

See that small clause about ETims and Electronic Tax Invoicing? Just wait for January . pic.twitter.com/Ra39MH6wos

See, I had sent in my usual tax invoice before the accolades rained and, as is my wont, naïvely sat pretty, eagerly awaiting to dig teeth into the fruits of my highly acclaimed labours. But alas and alack, it was not to be. I will quote Client directly:

"Sorry for the delay in payment, but our accountant is asking for an eTIMS invoice. Apparently it's the new law. You know how accountants are 🤷🏿♂️"

And so I prepared for the long, arduous journey to ascend Mount KRA to parley with the gods of excise. I still had my eye on that scintillating payment. You see, in the Kenya that William Ruto has created in his own image (or rather, in Yoweri Museveni's...but that's an article for another day), no coin is to be frowned upon. And then the comedy of errors began.

Unbeknownst to one, the first hint of the looming affliction was hidden deep in setting up the password in the "Sign up (PIN) - eTIMS Taxpayer Portal." For the love of Jesus Christ, our Lord and Saviour, at once God himself and only begotten son of the three-in-one God Almighty, I couldn't figure out what KRA Commissioner-General Humphrey Wattanga Mulongo wanted from me via this cypher. A pound of flesh too?

* This field is required* Invalid Password.

(12-20 digits, English uppercase/lowercase letters, numbers, special characters mixed)

Go figure.

Struggle as one might, one just couldn't get it right. Turns out this was the most difficult password one has ever had to register since one started using the Internet professionally in the mid-90s. Apart from the cryptic prescription (and in bad English to boot), one was not sure whether to use one's regular KRA portal password or what?!

And that's where my first challenge with eTims enters the story.

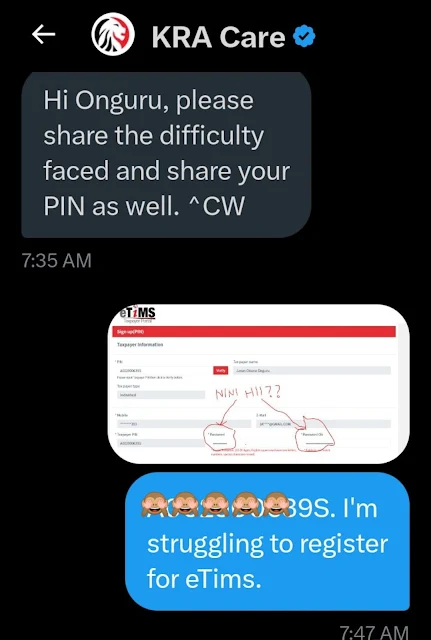

But KRA's struggles with one of just two official languages prescribed in the Constitution of the Republic of Kenya (promulgated in 2010) did not end there. (FYI, India has 22.) Being the exemplary corporate citizen that I am, I rushed to X, formerly known as Twitter, for further consultation, ingenuously unaware that more pain awaited there. I watched with tears in my eyes as my beloved Queen's (is it now King's since...you know?🤷🏿♂️) English got massacred beyond repair:

And so on, and so forth, ad infinitum.

And then it occurred to me: Surely, I can't be the only one going through this train smash. I recalled an episode from earlier in the year where farmers from Central Kenya complained bitterly on national TV about this new tax regime that they voted in to the last man, having finally come in close contact with the mysterious eTims ensuing from their blind vote. What are other Kenyans going through, I thought.

BREAKING NEWS: Kiambu is in the news! pic.twitter.com/wHAoKBAwSe

— 𝕵𝖆𝖛𝖆𝖓 𝕺𝖓𝖌𝖚𝖗𝖚™ 🇰🇪 🇺🇬 🇹🇿 (@OnguruMeister) March 5, 2024

Following in the example set by our august 13th Parliament as highlighted by the Avocado Scandal, it is entirely conceivable that not a single person out there can explain exactly what eTims is, or the broader consequences it forebears for the ordinary Kenyan.

So, what do we now know about eTims (that we did not know in December), and what are the wider implications for the spirit of entrepreneurship in this the Hustler Nation? The facts are these:

Understanding William Ruto's eTIMs and its Impact on Businesses and Entrepreneurship

The introduction of the electronic tax invoice management system (eTIMs) by KRA marks a significant shift in how businesses handle tax compliance. Essentially, eTIMs digitises the process of invoicing and tax record-keeping, aiming to streamline operations and enhance transparency in the taxation landscape.

What is eTIMs and Who Does it Affect?

Simply put, eTIMs requires businesses to generate and transmit invoices electronically to KRA. This applies to all businesses operating in Kenya, regardless of size or sector. Initially, there was a plan to exempt small businesses with an annual turnover of less than Sh5 million. However, this exemption has been rescinded, meaning that even small traders like yours truly and farmers must comply with eTIMs.

Implications for Businesses

The transition to eTIMs brings about several changes that businesses need to adapt to:

- Strict Tax Deductibility Rules: Previously, businesses could deduct expenses for tax purposes if they were incurred wholly and exclusively to generate income. Now, expenses must be supported by eTIMs invoices to be tax deductible. Failure to comply could result in a 30 per cent corporate tax liability. This requires businesses to meticulously adhere to eTIMs protocols to avoid penalties.

- Real-time Tax Monitoring: With eTIMs, KRA can monitor a business's tax position in real time. This means automatic invoice reconciliation and the ability to issue accurate tax demands promptly. While this enhances compliance, it also means businesses must stay on top of their tax obligations continuously.

- Automated Audits: eTIMs enables KRA to conduct automated assessments using comprehensive transaction data. This reduces the need for labour-intensive in-person tax audits. However, it also means that businesses must maintain accurate tax records to avoid discrepancies.

- Streamlined VAT Processes: eTIMs automates VAT registration based on revenue thresholds, eliminating the need for manual declarations. This simplifies the process for businesses but requires them to be aware of their VAT obligations as they grow.

Impact on Entrepreneurship

The implementation of eTIMs has both positive and negative implications for entrepreneurship in Kenya:

- Compliance Challenges: For small businesses and entrepreneurs, the transition to eTIMs poses challenges due to technological barriers or lack of awareness. Compliance costs could also be burdensome for startups with limited resources.

- Transparency and Accountability: On the flip side, eTIMs promotes transparency and accountability in tax compliance. By digitising invoicing and record-keeping, it reduces the likelihood of tax evasion and enhances trust in the business environment.

- Need for Education and Support: To ensure the success of eTIMs and support entrepreneurship, there is a need for education and support programs. This could include training on eTIMs usage, assistance with compliance, and initiatives to mitigate the impact on small businesses.

So, while the implementation of eTIMs presents challenges for businesses, it also offers opportunities to improve tax compliance and foster a more transparent and accountable business environment in Kenya. However, it will require concerted efforts from both the government and the business community to navigate the transition effectively and support entrepreneurship in the country.

And so, as I reflect on my tumultuous eTIMs journey, what with navigating through cryptic password instructions and witnessing the butchering of the Queen's English on X, formerly known as Twitter, I can't help but snigger at the absurdity of it all. William Ruto's tax regime may be as unforgiving as a deputy president scorned, but hey, we're all in this circus together, juggling invoices and dodging audit bullets.

In the grand scheme of things, adapting to Ruto's draconic tax regime is just another chapter in the never-ending saga of survival in the wild savannah of entrepreneurship in Kenya. We dance to the tune of eTIMs, not because we're thrilled about it, but because in this dog-eat-dog world of business, you either adapt or you become yesterday's lunch special.

So, here's to embracing eTIMs with open arms (and perhaps a dash of sarcasm), because let's face it, the only thing more certain than death and taxes is the unyielding hustle of the Kenyan entrepreneur. As we raise our virtual glasses to toast to another day of dodging tax pitfalls and deciphering KRA's enigmatic messages, let's remember: in the Hustler Nation, adaptability is our currency, and laughter is our lifeline. Cheers to surviving another day in the jungle of Kenyan entrepreneurship, where the only thing scarier than a tax audit is the thought of missing out on a lucrative deal. As Jose Chameleon once put it, and I couldn't say it any better if I paid tax on it, nekolela maali!

- Get link

- X

- Other Apps

Popular Posts

Who’s Nailin’ Paylin?

- Get link

- X

- Other Apps

A selection of Kenyan women

- Get link

- X

- Other Apps

.jpeg)

.jpg)

Comments